Posted: September 16th, 2015 | Author: Simo Isomaki | Filed under: Telecom Trends | Tags: 4G, VoIP, VoLTE, VoWiFi | Comments Off on Weighing the Pros & Cons of VoLTE

There has been a lot of interest around Voice over LTE (VoLTE) lately, not to mention thorough analyses on the benefits of the technology and recorded rollout activities across the globe.

There has been a lot of interest around Voice over LTE (VoLTE) lately, not to mention thorough analyses on the benefits of the technology and recorded rollout activities across the globe.

According to the Global mobile Suppliers Association (GSA), there are as many as 16 VoLTE launches in seven countries, as operators look to embrace HD voice. In a press release and as noted in FierceWirelessEurope, Alan Hadden, VP of research at the GSA, said: “Interest in VoLTE has surged, and [more than] twice as many operators are investing in VoLTE compared to a year ago. Many more launches will happen in 2015.”

Despite VoLTE’s success thus far and its growing number of deployments, uncertainties around the technology remain.

First, there is the required handset support for VoLTE. Based on studies done by tefficient, surprisingly few of the 4G handsets on the market are equipped for the technology since early implementations of VoLTE were based on partial standards or proprietary solutions. VoLTE works best for operators like those in Korea, Japan and the United States that have full control over handset distribution.

Second, VoLTE support in networks is still implementation-specific, meaning that calling from one network to another using VoLTE might not be possible—even in the same country. As an indication of the complexity, VoLTE roaming is only just starting to happen. KPN claimed the world’s first case as late as in October 2014.

For operators who haven’t had full control over handset distribution, the solution might currently have to be as harsh as making sure that customers joining them replace their handset—even if it’s 4G—with one that the operator knows has the right combination of hardware, firmware and software to function in their VoLTE network.

So while VoLTE is a relatively new, emerging technology—a richer multimedia voice and video call service based on IMS—the question is: is it a MUST for digital and communications service providers? They must thoughtfully consider this question because, if they are not going to take it onboard, they are about to lose their lucrative and long-lasting, but currently declining traditional voice revenue.

This was recently confirmed in The Guardian. As written in the article, Paul Lee, head of technology, media and telecommunications research at Deloitte, said that VoLTE—phone conversations carried over the data connection of a 4G network, which are of higher quality and can be switched from an audio call to a video call—are likely to supplant traditional phone calls over the next decade.

Another common concern and question is Voice over IP (VoIP) as VoLTE or VoIP in another means. Take VoIP services like Skype, Viber and WhatsApp. VoLTE goes beyond these in aspects like being able to handle radio networks’ handover and support emergency calls. The technology also promises superior voice quality. But are Generation Cloud customers willing to pay extra for this? It’s highly unlikely.

So, if VoLTE supplants traditional phone calls, will it significantly improve operators’ business by presenting a revenue boost for voice? Again, this is highly unlikely. Based on the VoLTE services on the market thus far, it seems that these voice calls are charged similarly to ordinary ones, where video comes on top in form of data charging.

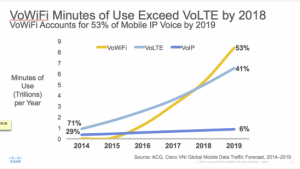

Source: Cisco Blog

Here comes the interesting expansion of the voice business, which VoLTE indirectly enables: native Wi-Fi calling (or Voice over Wi-Fi or VoWiFi). Every cellular network—no matter how good it is—will have coverage issues indoors. In most cases, there’s Wi-Fi coverage to act as support.

With native Wi-Fi calling, mobile customers will seamlessly carry calls over existing Wi-Fi when there is no cellular coverage. Similarly to VoLTE, these calls are charged as any regular voice call, but here we are talking about a call that could not have happened without Wi-Fi. Consequently, it means additional voice revenue for the operator (or it could mean unlimited voice plans become more frequent). The same IMS handles both VoWiFi and VoLTE—with the latter technology being a pre-requisite for handover to happen between VoWiFi and cellular. (If you don’t have cellular indoor coverage, you obviously need to be able to move in and out of your house without dropping calls.)

With this in mind, we should stop looking at VoLTE in isolation and instead consider VoLTE in tandem with VoWiFi.

VoLTE also offers huge potential for cost-savings. When voice and other services are converged on LTE, and when customers have fully bought into them, digital and communications service providers are able to shut down their circuit-switched 2G and 3G networks. This will have a huge impact on operators’ profitability.

So do digital and communications service providers possess the knowledge and assets for what it takes to launch VoLTE successfully? We’ll discuss this in a coming blog post—please stay tuned.

Malla Poikela of Comptel co-wrote this blog post entry.

Posted: November 22nd, 2013 | Author: Kari Jokela | Filed under: Around the World, Telecom Trends | Tags: 4G, LTE, Media, OTT, social media | Comments Off on A Telco Opportunity: In Taiwan, Mobile has Replaced TV as the Media of Choice

Most analysts agree that widespread 4G deployment is right around the corner in Taiwan. The nation has always been a prominent mobile player in the telecommunications market, especially with initiatives like the Mobile Taiwan program, which have emphasized wireless access for all Taiwanese citizens, whether they’re in New Taipei City or a village in the mountains.

According to 4G360, the region’s communications service providers (CSPs) are looking to enter the 4G market early next year. With the infrastructure in place, this could open a world of new opportunities, especially considering the sheer amount of data being exchanged across networks in Taiwan already.

One new study from InMobi highlights this phenomenon in detail. The research shows that, on average, mobile users in Taiwan spend six hours consuming media each day. More than a quarter (27 percent) of that time is spent on a mobile device, making it the number two channel for media consumption after desktops and laptops and actually placing it ahead of television. And even when they are watching TV, 20 percent of Taiwanese users surveyed said they look at their mobile phones at the same time.

So what does this all mean for CSPs in Taiwan? Mostly, it shows that it’s time to look at their customer relationships in a whole new way.

An Exponential Experience

Recently, Digitimes asked the three largest CSPs in Taiwan, Chunghwa Telecom (CHT), Taiwan Mobile (TWM) and Far EasTone (FET), about their thoughts on the future – especially when it comes to 4G. The consensus was that competition would be stiff. When it comes to 4G, CSPs won’t just be battling for market share with traditional operators, there will be an intensifying contest between CSPs and OTT providers like Google, Facebook and the services available from the iTunes App Store.

“Unlike 3G, which is positioned mainly as an access [point] to the Internet, telecom operators have to think of 4G as a platform to provide various application services,” said FET President Yvonne Li. “In this respect, FET stresses establishment of close cooperation [and] relation[ships] with subscribers.”

She added that, in the competition against OTT providers, CSPs won’t win in the race to build the best product or technology. Instead, they should strive for superior subscriber relationships and retail channels.

Improving subscriber relationships means paying closer attention to what customers want and need from CSPs. As VP of Research Monica Zlotogorski recently wrote on Telesperience, that hasn’t historically been the strongest point for telecom operators.

FET has taken strides to improve the customer experience already, investing in technology that allows for more intelligent mediation, charging and fulfillment.

More Media, More Problems

The revelations about Taiwanese mobile media usage should strike a chord among CSPs. Usually, telcos are seen as obstacles to getting the media the user wants – whether the connection is slow, there’s a limit on a data plan, or Wi-Fi is hard to find.

A lot of this has started to change within the past few years because of Big Data analytics tools, which can segment customers by mobile usage and allow CSPs to customise different marketing offers and networks accordingly. As 4G becomes widespread and media becomes even more accessible than before, optimising the customer experience will be a crucial strategy for telcos that are looking to stay ahead of OTT providers. By becoming a strategic and intelligent service enabler, CSPs can become an active and integral proponent of a customers’ needs, making sure the journey is as smooth as possible, from start to finish.

Posted: November 12th, 2013 | Author: OSS Team | Filed under: Around the World | Tags: 4G, analytics, Around the World, Big Dat analytics, big data, CEM, LTE | Comments Off on Around the World: Connectivity in Africa, Big Data Analytics and Adaptation

This week, there were a number of new insights across the telco industry. At Comptel, we’ve been keeping track of the ones that have really caught our eye. Here are three interesting articles that have come out recently:

Developing Telecoms…

LTE Investment Key to African Connectivity

A panel of experts was asked by West Indian Ocean Cable Company (WIOCC) how they would invest $100 million to improve Internet access in Africa, where connectivity is currently at the lowest rate in the world. Developing Telecoms’ editor James Barton believes that installing new 4G/LTE networks would create the best return on investment. He added that once people in Africa start accessing next-generation mobile networks, new competitive markets can open and, in turn, make Internet access more affordable.

Earlier this year, we wrote about the upcoming boom in mobile devices in Africa. By 2016, it is forecast that there will be more than one billion phones across the continent. The $100 million investment proposed by WIOCC may be hypothetical right now, but the need for 4G/LTE in the continent is a reality.

Information Management …

Big Data and Analytics Help Business Transform and Gain Competitive Advantage

Communications service providers (CSPs) are turning to Big Data analytics tools to cope with the constant changes in technology and consumer behavior. Through the use of these solutions, they can better adapt to new customer trends and prevent churn. CSPs, in particular, deal with a heavy amount of data, because of the high volume of calls, texts and data usage traveling across their networks each day. All of that information can be harnessed to create more targeted marketing offers, support better business planning and drive innovative infrastructure deployments.

Ulla Koivukoski argues that Big Data could potentially bridge silos across an organisation, too. By working with CTOs and CIOs, CMOs can create personalised campaigns by drawing contextual intelligence out of the network, customer and other data available to them. Consequently, silos can be overcome, and CSP executives can work toward the common goal of enhancing the customer experience.

Billing & OSS World…

CSPs, Other Businesses Aren’t Adapting to Customers

A recent study by Ovum found that 90 percent of CSPs and other businesses are at risk of being irrelevant to their customers in the near future. Because of organisational silos and slow decision cycles, dynamic customer responsiveness is lacking. The findings show the need to create a fluid customer process that ensures each individual receives personalised attention in a timely manner. Building relationships with customers and earning their trust can help organisations remain relevant, and increase overall customer satisfaction and loyalty.

Posted: April 10th, 2013 | Author: Malla Poikela | Filed under: Industry Insights | Tags: 4G, contextual predictive analytics, LTE, predictive analytics | 1 Comment »

LTE use has been following an almost frighteningly fast growth curve. Global LTE traffic is expected to increase by 207% this year, and LTE customers are supposed to double in 2013, surpassing 100 million. Around the world, communications service providers (CSPs) are building new infrastructure to keep up with consumers’ demand for faster data speeds.

The Philippines is no exception – mobile subscribers grew from 6 million in 2000 to 92 million in 2011. By 2016, mobile subscription is expected to reach 117 million people, with a penetration rate of 114 percent.

Since August 2012, LTE has been slowly rolled out across the country, too, covering major cities like Metro Manila, Cebu, Davao, and Boracay. Major CSPs are spearheading the trend. An operator in the Philippines recently announced that it built LTE cell sites to service regions across Luzon, Visayas and Mindanao. And other operators have made similar moves into the LTE space.

Yet offering LTE service and having the right strategy in place to monetise it are sometimes two very different things.

A Demand for Personalisation

Whenever a CSP deploys a new service, the next step is to get people to use it. In the Philippines, we need to consider four big findings among Filipino subscribers who participated in our recent Vanson Bourne survey:

- 84 percent would download more files if they had a better mobile data plan.

- 67 percent top up their phone plans at least once a week.

- 72 percent want personal service when experiencing poor connections.

- 70 percent are likely to pay for a temporary bandwidth upgrade.

- 64 percent have two or more SIM cards

This data shows that there’s not just a demand for the faster data speeds LTE offers, there’s a demand for better, more personalised interaction with CSPs.

Sure, it’s possible to offer customers the same bundled package, but as competition increases, so, too, will innovative pricing packages. In a country like the Philippines, where so many people are topping up every week, it may mean that they’d be open to a new data plan, but they can’t find one that’s suitable.

Yet we see that nearly three-quarters of customers would consider paying for a temporary upgrade. That indicates that if personalised upsells were offered, CSPs could potentially realise greater revenues, because consumers would be willing to take advantage of these special deals.

Adapting for a Country’s Changing Needs

The smartphone phenomenon will change a lot of things, too. Last year, there was a 400 percent increase in demand for smartphones in the Philippines, with penetration expected to grow from 18 percent to 50 percent in the next three years. This trend is going to enable more internet and data use than ever before. One survey showed that more than 80 percent of Filipinos have two or more personal devices, and among that number, 85 percent bring those devices to work.

LTE deployments and a growing acceptance of personal devices at the workplace are going usher in a lot of new changes for CSPs. In short, it’s going to be more important than ever for them to find a way to use the data at their disposal to their advantage.

With predictive analytics, for example, CSPs can analyse their customers, networks and other information, to determine which sets of customers would really benefit from full LTE use and which would most likely only want to use LTE sparingly. This way, promotions can be tailored accordingly, everyone will get the package they want and need, and CSPs can improve relationships in a way that builds loyalty and business performance.

Posted: March 1st, 2013 | Author: Ulla Koivukoski | Filed under: Events, Industry Insights | Tags: 4G, analytics, LTE, Mobile World Congress, Unified data | 4 Comments »

As I mentioned the other day, Mobile World Congress was filled with excitement, with a robust exchanging of ideas among the various attendees and our customers and partners, as we look to the future of telecom. At the show, we were happy to further some of the discussions on LTE and analytics by welcoming a few guest speakers to Comptel’s booth.

The founder of operator benchmarking consultancy tefficient, Fredrik Jungermann, took us through how to pinpoint the right LTE customers. He first mentioned that not as many LTE customers are signing up as operators would like, but the numbers are rapidly growing. For example, 58% of Korea’s data traffic was over LTE in December 2012, and, likewise, Tele2 in Sweden saw an LTE penetration of 40%.

Fredrik explained that we’re transitioning away from a world of unlimited data, with more demand now put on unlimited voice and text. Of the smartphone data that is being used, 60% is through Wi-Fi, which is going un-monetised. With this in mind, he posed the question: what if operators could turn things around and monetise this traffic using LTE or operator-owned Wi-Fi?

The upsides include basic monetisation, which will mainly be based on volume, and as data traffic grows over the top (OTT) players can become an additional source of revenue. Further, offering shared data plans will help enable unused devices and drive revenues even further. The downside to this, though, is that it can be costly to supply LTE handsets, as they have the highest specs. Analytics can help match the expensive and rare handsets to the right customers – dynamically based on individual customers’ needs and behaviours. Overall, this is much more efficient than providing subsidised LTE handsets to everyone.

Additionally, we heard from Zain Kuwait’s director of management information systems, who delved into the various ways the company is improving the customer experience with analytics. If you are interested in learning more about this presentation, as well as Fredrik’s, please email [email protected].

What did you think of this year’s Mobile World Congress? We’d love to hear your favourite highlights and if you heard any interesting news or stats around LTE and analytics. Safe travels home to all!

Posted: February 22nd, 2013 | Author: Malla Poikela | Filed under: Industry Insights | Tags: 4G, bandwidth, big data, communications service providers, CSPs, data, LTE, mediation, Network, policy management, predictive analytics, real-time, real-time charging, upsell | Comments Off on What Technologies Are Impacting Policy Management?

I was recently talking about policy management with my colleague, Ulla Koivukoski, and started thinking about how far we’ve come and how it will continue to evolve. All of the new and advanced technologies that have been introduced in the past couple of years are having a big influence on this, and will continue to shape how communications service providers (CSPs) utilise policy management capabilities.

One of the most prominent of these technologies is 4G/LTE. Because LTE enables faster data speeds, customers will inevitably want to consume more and more data. CSPs who can gain deeper insight into such data usage will have a clear advantage. For policy management specifically, this means the ability to provide different packages with different rating models that are unique to customers’ behaviours. It also means implementing bandwidth or data caps in certain instances– otherwise, we’d use all of our network capacity!

Adding to this, it’s crucial for CSPs to identify the impact of down throttling on individual customers who are likely to churn and/or cause a revenue loss. For example, if customers experience poor quality of service (QoS), CSPs need to be able to proactively offer them a higher bandwidth or data package. In this way, the risk for revenue loss and customer churn can be mitigated while simultaneously improving QoS for the right customers. Further, a predictive analytics engine can suggest which customers will be most valuable for CSPs based on pre-defined Key Performance Indicators (KPIs), and which customers desire a corrective action to keep them on-board (e.g. a dedicated bandwidth prioritisation).

CSPs also can benefit by tightly coupling policy control with real-time charging. Like our recent consumer research demonstrated, financial considerations like personalised product/service promotions can influence customer behaviour. So, if CSPs can not only dynamically control the packages that are being delivered to customers and how, but also competitively price their offerings, they can increase the amount customers are willing to spend and maximise their revenue.

Linked closely with this is big data, which is giving CSPs a huge opportunity to add value. To tap into the power of big data, CSPs must first sift through and analyse the immense data volumes, both structured and unstructured, to get complete views of their customers. With this, CSPs can offer new services and bundles to customers with both efficiency and rapid time-to-market. Adding to this, a combination of advanced analytics and mediation enables CSPs to begin use cases like proactive broadband upsell for customers based on the prediction of their changed usage pattern, premium user identification, and automatically approaching customers with the right offer, in the right context.

Another technology making an impact on policy management—and one that goes hand in hand with big data—is the cloud. More and more, the cloud is one of the best options for storing and processing data. It allows for offline processing and the ability to trigger information online, to achieve real-time, personalised campaigns. Latency and security threats remain a concern, but if these can be managed properly, then I see policy making a big shift to the cloud.

Of course, this is just the tip of the iceberg – there are many more advancements being made every day. As our world and the technologies in it continue to evolve, I look forward to seeing how policy management will grow and change to drive a better, more efficient customer experience.

Posted: October 2nd, 2012 | Author: Steve Hateley | Filed under: Industry Insights | Tags: 4G, business operations, catalog, communications service providers, CSPs, OSS/BSS, product lifecycle management, Service Provider IT, SPIT | Comments Off on More on the Catalog Conundrum

While some are still a bit hesitant to adopt a service-layer catalog, we’re seeing communications service providers (CSPs) use it more and more as a driver for their overall business operations. This is especially true as service portfolios become broader, and as CSPs realise that simple commercial product catalogs can’t deliver the agility and rapid deployment needed to help them effectively compete. I recently wrote about this and the various benefits catalog can bring to CSPs, especially in terms of making product lifecycle management more efficient. Now, I’d like to dive a bit deeper into why catalog initiatives are a must for service provider IT (SPIT).

Catalog has traditionally played a role in many proof-of-concept exercises, as it can make product development and deployment easier, faster and less expensive. However, most CSPs haven’t followed these ideas through to operational adoption. This is starting to change as emerging technologies are fuelling the need for new tools to manage product lifecycles, and increasing organisational complexity only adds to this need. Meaning, CSPs must manage converging technologies and dispersed capabilities across departmental and service boundaries, which demand that formal management of the service lifecycle be a key part of the OSS/BSS architecture – cue catalog.

While CSPs realise the need for progress, one of the biggest obstacles they face in shifting to a catalog-driven approach is fear of transformation and the subsequent impact on existing processes. Alleviating these fears may be as simple as introducing catalog in phases to various departments rather than to the entire organisation at once. It’s important to think about the longer term benefits, too. CSPs can realise substantial architecture paybacks by integrating a system that wraps and re-uses its legacy infrastructure with new catalog-driven models.

When considering the investments being made in various technologies like 4G, coupled with the demand for personalised product delivery, catalog initiatives seem essential for management and have the potential to ensure true differentiation in the market. There is a very real possibility that the traditional OSS/BSS boundaries and architectures of the past will be completely redrawn, with service catalogs at the centre of the new SPIT platform. Do you agree?

Posted: July 24th, 2012 | Author: Ulla Koivukoski | Filed under: Industry Insights | Tags: 4G, analytics, bandwidth, CIQ4T, Comptel, contextual intelligence, customer experience, Heavy Reading, Making Data Beautiful, Monetisation, Podcast, Quality of Experience | 1 Comment »

In part one of our two part series, Heavy Reading analysts Ari Banerjee and Sarah Wallace discussed contextual intelligence for telecoms (CIQ4T) and how this type of approach, which provides advanced analytical insights for a holistic customer view, can improve engagement and elevate the customer experience.

Now, in the second and final installment, Ari and Sarah delve a bit deeper into what this actually means for service providers and explore some real-life examples of putting CIQ4T to work, such as monetisation, network resource optimisation and dynamic profiling with advanced analytics.

As I mentioned in one of my earlier blog posts, the telecommunications industry needs to increasingly predict what is important to customers rather than simply being reactive – and analytics plays a key role in helping to achieve this. Ultimately, turning all of this data into actionable information helps to bring people close together and furthers our goal of making data beautiful.

Like last week, you can listen to the full podcast of the conversation here or read the highlights below.

Ari Banerjee: Can you talk a little bit about the use cases that Comptel is addressing today that are more customer-facing?

Sarah Wallace: One of the first use cases is obvious but also very important, and that’s monetisation. This includes upselling to the customer, offering them something that might be triggered through some type of complaint, or offering them a new service. Another aspect of this is cross-selling – identifying subscribers and offering something they don’t necessarily need but that fits their usage pattern. So, for instance, service providers could offer a device with its own hot spot to a customer who may travel a lot.

Then, of course, there’s the aspect of new customer acquisition when it comes to monetisation. This entails identifying influencers in the network that might have a lot of off net relationships and making them an offer that will compel them to spread it virally – subsequently acquiring new subscribers.

Ari Banerjee: Beyond that, there’s the whole element of network resource optimisation. As we all know, when it comes to wireless, bandwidth management and resource management become extremely critical. Looking at the evolving wireless industry and all of its networks, 4G rollout is happening almost everywhere across the globe with LTE as the preferred route that most operators have taken.

With this comes another element of how to use spectrum, bandwidth and network resources better – especially when we look at services that are becoming more popular to enterprises or to consumers. These are really services that are low latency – those that revolve around video content and media. How do you provide expected quality of experience? All of that, again, needs advanced analytics or use of CIQ4T in a much broader way. Therefore, an OSS/BSS vendor already in the network can provide a lot more value additions for service providers.

One of the things that we are seeing operators challenged in is around cell-site optimisations. As we know, 4G networks are challenging because of things like traffic load balancing, handing over traffic between cells, determining where to put small cells – all of these need much more contextual information. So if OSS information is joined with contextual information, such as user experience, location and so forth, there’s a typical pattern of user-behaviour that can be mapped out.

Analytics can show that reducing power of one cell in favor of another cell might improve the overall network. Also, it can provide intelligent analysis around experience of a small set of high value customers who are typically using demanding services at a set time during the day, and how this can be handled in a better way based on load balancing across different parts of the network.

Subscriber-centric wireless offload – this becomes very important – and any operators who are providing 4G services are talking about wireless offload. This is because you cannot keep a subscriber on 4G continuously, it must instead be offloaded. Can this be done more intelligently using analytics? Can decisions be made based on the profitability of the customer lifetime value? Is there an SLA attached to the customer? Are they part of an enterprise contract? All of these different dimensions come through and are brought together via OSS/BSS systems and then intelligent decisions can be made based on which subscriber to offload. Again, use of CIQ4T and advanced analytics plays a major role here.

Service control based on subscriber profiles is another area that we think CIQ4T makes a lot of sense. By augmenting network data with subscriber data, utilising behavioural patterns, matching subscriber preferences and so forth, services can be tailored according to different users on the same subscriber account. So, for example, giving a company’s directors priority service compared to other employees, or managing a parent’s business applications in a different way than the entertainment applications used by their children.

So again, advanced analytics can also drive policies, which can drive service elements in the network and these can be programmed into things like policy servers for enforcement throughout the network in a much more soft-ticketed fashion.

Sarah Wallace: Some other use cases in addition to that include real-time churn prevention. This means being able to examine behaviours in subscribers who are obviously going to churn. Various elements to observe are multi-SIM prediction, rotational churn, and even churn location (do they reside in an area that has a propensity for high churn?)

Another use case is the concept of dynamic profiling with advanced analytics. This entails examining characteristics such as their usage, interests, location, socio-economic class, influence in their network (SNA), overall propensity to churn and their relationship to off net users.

Then, of course, there’s SNA which is a sub-set of advanced analytics. It’s really just looking at social networks in the sense of relationships – looking at family, friends and co-workers – and seeing what kind of influence the subscriber has in their sphere.

The last use case is advanced offer management – enabling service providers to confirm which promotions and service bundles are successful to offer including loyalty points, event and rule-based promotions, traffic-based promotions and management capability based on data subscriber network usage.

Personally, it makes me happy to think that Comptel’s software can be – and is – a part of the lives of so many people. And as consumers have different expectations for quality of experience, one of my personal favourite use cases is defining how to provide the experience that is right for each customer. Which use case do you find most appealing for CIQ4T?

Reflections on LTE Advanced – Part One

Posted: April 27th, 2012 | Author: Simo Isomaki | Filed under: Industry Insights, Telecom Trends | Tags: 4G, bandwidth, communication service providers, CSPs, FTTH, LTE-A, LTE-Advanced, Network, Smartphone | 1 Comment »

When following the hot industry trends, I found a lot of excitement around LTE-Advanced (LTE-A) and wanted to share my thoughts on this emerging technology.

So what is LTE-A?

Well, in the simplest of terms, it’s the latest advancement in radio technology that will put one Gigabits/s bandwidth (or 1000 megabits/s) to your mobile device of choice, whether it’s a laptop, dongle, tablet or smartphone (and eventually feature phone). Network rollouts will occur once the technology is proven in trials and compatible devices are available.

For comparison, you can get up to 100 megabits/s through LTE technology and up to 24 megabits/s with ADSL technology. The bandwidth that LTE-A enables is similar to the fastest speeds from Fiber-to-the-Home (FTTH) technology and about three times faster than that of cable. It is also approved by the International Telecommunications Union as the true 4G technology irrespective of what industry marketing and some communications service providers (CSPs) are saying about LTE and DC-HSPA. Globally, we are just deploying LTE infrastructure, and thus, LTE-A will have its first major deployments sometime in the future.

Some Perspective

While the maximum speed will most likely be very theoretical, at least in the beginning, the technology promises to provide all of the bandwidth we need without wiring everything together physically, allowing for true mobility. To put that bandwidth into perspective, one HD quality video stream can consume up to tens of megabits per second depending on the encoding/decoding technology used. This would then decide how much of the CPU and graphics chip on your device would be used and how much battery life they consume on decoding the video feed. The less bandwidth that is consumed (and hence tighter compression used in video encoding), the more work the CPU and graphics chip will have to do, and more battery will be consumed. In theory, you would not need much video compression with LTE-A, as there is plenty of capacity and hence less demand on battery, CPUs and other chip development needs. Think about several HD video channels being streamed to your device and having the ability to use other services in parallel. It would also enable higher upload speeds, so your multi-megapixel DSLR pictures could be streamed to your cloud storage or photostream of choice in near real time.

Is there really a need for this much bandwidth?

I’ve witnessed first-hand that once more bandwidth is available, it will get used. Remember the times of MS-DOS and the famous statement that 640 kB of memory is enough for everything? I’m feeling a bit old here, but seriously, we are masters of consuming 97% of our hard drives, for example, no matter what the capacity is—and the same applies to bandwidth. With recent advancements in HD displays in relatively small form factor (e.g. retina display in the new Apple iPad), it’s almost guaranteed we will consume available bandwidth. I’d think, however, that with such bandwidth, the need for large local storage on devices becomes less important, especially as cloud storage is becoming more affordable. Hence, we will see more video-enabled devices with minimal, built-in storage capacity.

LTE-A sounds promising, right? In my next post, I’ll discuss this technology further and highlight some areas where there’s room for improvement.

Posted: April 13th, 2012 | Author: OSS Team | Filed under: Around the World | Tags: 4G, 5G, bill shock, data, leakage, LTE-A, revenue assurance | Comments Off on Around the World

New York Times…

A Ballooning Megabyte Budget

Limited data plans are pushing customers to carefully budget their megabytes and more closely track their mobile usage. Confusion abounds, however, as many consumers aren’t sure how to quantify megabytes, and upgrades to faster devices and networks speeds are encouraging people to use more data-intensive applications but are leaving them to deal with unexpected charges .

To avoid data plan confusion and bill shock, mobile operators are offering tiered data plans and promoting transparent billing by giving customers options for monitoring their data. Some operators, for instance, are sending text messages to update consumers on their allotted and remaining data usage.

According to the article, many customers aren’t aware that data monitoring tools exist or have not used them to budget their data use. Therefore, operators need to improve their customer interactions and demonstrate the value of these resources to help customers take the right steps towards budgeting their megabytes.

Total Telecom…

Leakage Could Cost Mobile Operators $296bn in 2016

According to Juniper Research, if mobile operators fail to update their revenue assurance systems, their revenue losses from leakage could balloon to $296 billion in 2016, up from $58.4 billion. To minimize the risk of fraud, the firm recommends installing a real-time system to monitor and react to criminal activity, in addition to processing and validating all billable transactions.

Supporting this, research from KPMG shows that 50 percent of operators in Africa and the Middle East lose more than one percent of revenue through leakage. Losses can often be linked to improper billing operations, placing additional impetus for operators to ensure their billing systems are properly integrated into the operations support system (OSS) and business processes. As the head of KPMG says, the hope is that these figures act as a “wake up call” for the industry and encourage operators to invest in revenue assurance and fraud management systems to prevent increasing revenue losses.

Light Reading…

Ready or Not, Here Comes LTE-Advanced

Even though Long Term Evolution-Advanced (LTE-A) networks won’t be a mainstream technology until 2015, some operators are making their commercial debut with the technology and claiming to be “LTE-A ready”. This is spurring a debate over what is and isn’t 4G—and even 5G.

As marketplace confusion with network labels grows, savvy customers are increasingly asking, is a network truly LTE-A only when it uses multiple-input, multiple-output (MIMO) orders of 4×4 or higher? At 8×8, does it become worthy of a 5G marketing moniker? The answers to these questions could dictate how operators are able to differentiate their services and respond to customer needs.

According to a Heavy Reading report, despite the debate surrounding LTE-A, the emerging network is worth paying attention to because its ultimate impact will be widespread. Do you agree with the report’s prediction that LTE-A will dominate the global market? And what do you think is the value of knowing an operator is “LTE-A ready”?

There has been a lot of interest around Voice over LTE (VoLTE) lately, not to mention thorough analyses on the benefits of the technology and recorded rollout activities across the globe.

There has been a lot of interest around Voice over LTE (VoLTE) lately, not to mention thorough analyses on the benefits of the technology and recorded rollout activities across the globe.