Posted: December 15th, 2015 | Author: Simo Isomaki | Filed under: Industry Insights | Tags: Monetisation, VoLTE | No Comments »

When we wrote about the state of the Voice over LTE (VoLTE) market little while ago, we discussed the obstacles that operators could face when deploying the emerging technology. Although the number of VoLTE projects is growing, it’s worth asking the question: just how disruptive will high-definition voice be as a revenue generator?

The answer? It’s hard to believe that VoLTE will be the killer app that significantly increases operator revenue.

That’s because, from the consumer perspective, it won’t seem like much has changed at all. They will still open the voice “app” on their phone to make a call. Yes, there will be a handful of new features, including the ability to switch from an audio call to a video call, and, of course, superior voice quality. But, these aren’t features consumers would necessarily want to pay extra for, and if operators charge the same for VoLTE as they do traditional calls, the revenue point is moot.

However, that doesn’t invalidate VoLTE’s value as a service differentiator. The key to unlocking new sources of revenue from VoLTE will be in adopting a flexible monetisation approach.

That will require operators to think beyond pre-configured VoLTE service packages. Operators might opt for these because it seems to be an easier way to try an emerging technology, but they put themselves at a disadvantage.

When the vendor controls everything about how VoLTE is configured, you can only sell the service the way the vendor has dictated. You aren’t able to customise the way you implement and monetise VoLTE based on local market factors. It can often take you longer to implement the technology in the first place or change your implementation based on new developments. Overall, this means operators are slower, less proactive and have a harder time meeting customers’ unique needs.

It also limits other benefits of a VoLTE deployment including efficiency in the network, the ability to reform the cellular spectrum and improved cost competitiveness. Those will all save operators money, but they don’t add up to dramatically improved revenue. It’s better if operators have the power to customise VoLTE implementation and monetisation.

Perhaps you want to bundle VoLTE and Voice over Wi-Fi (VoWiFi) services together. Maybe you don’t. Maybe you want to give VoLTE away to enterprise customers free of charge, bundling it as part of a larger corporate offering. Or maybe you’ve thought of an entirely new way to monetise the new technology that no one else has considered.

Ultimately, it should be up to you, not your vendor, to find the right way forward. Configurability in service monetisation is a key factor in achieving business elasticity, a concept we’ve discussed recently. For operators to be elastic – which defines their ability to change, upgrade, improve and react quickly to dynamic market changes – they will need to ensure their VoLTE capabilities are free from the fixed limitations of traditional vendor engagements. Elasticity is a key capability that requires fast, tailored, highly responsive customer service.

VoLTE is not a silver bullet, but that doesn’t mean operators should leave money on the table. Opt for a vendor that will let you configure VoLTE the way you want, and then start thinking of creative new ways to monetise it.

If you missed it, read the first blog post in this series, where we evaluated VoLTE pros and cons. And keep an eye out for our next piece, where we’ll cover the future of VoLTE and where we think this emerging technology will fit in the broader world of digital and communications services. If you want to control your own destiny and deploy VoLTE features the way you want it, the MONETIZER™ is there for you.

Posted: September 16th, 2015 | Author: Simo Isomaki | Filed under: Telecom Trends | Tags: 4G, VoIP, VoLTE, VoWiFi | No Comments »

There has been a lot of interest around Voice over LTE (VoLTE) lately, not to mention thorough analyses on the benefits of the technology and recorded rollout activities across the globe.

There has been a lot of interest around Voice over LTE (VoLTE) lately, not to mention thorough analyses on the benefits of the technology and recorded rollout activities across the globe.

According to the Global mobile Suppliers Association (GSA), there are as many as 16 VoLTE launches in seven countries, as operators look to embrace HD voice. In a press release and as noted in FierceWirelessEurope, Alan Hadden, VP of research at the GSA, said: “Interest in VoLTE has surged, and [more than] twice as many operators are investing in VoLTE compared to a year ago. Many more launches will happen in 2015.”

Despite VoLTE’s success thus far and its growing number of deployments, uncertainties around the technology remain.

First, there is the required handset support for VoLTE. Based on studies done by tefficient, surprisingly few of the 4G handsets on the market are equipped for the technology since early implementations of VoLTE were based on partial standards or proprietary solutions. VoLTE works best for operators like those in Korea, Japan and the United States that have full control over handset distribution.

Second, VoLTE support in networks is still implementation-specific, meaning that calling from one network to another using VoLTE might not be possible—even in the same country. As an indication of the complexity, VoLTE roaming is only just starting to happen. KPN claimed the world’s first case as late as in October 2014.

For operators who haven’t had full control over handset distribution, the solution might currently have to be as harsh as making sure that customers joining them replace their handset—even if it’s 4G—with one that the operator knows has the right combination of hardware, firmware and software to function in their VoLTE network.

So while VoLTE is a relatively new, emerging technology—a richer multimedia voice and video call service based on IMS—the question is: is it a MUST for digital and communications service providers? They must thoughtfully consider this question because, if they are not going to take it onboard, they are about to lose their lucrative and long-lasting, but currently declining traditional voice revenue.

This was recently confirmed in The Guardian. As written in the article, Paul Lee, head of technology, media and telecommunications research at Deloitte, said that VoLTE—phone conversations carried over the data connection of a 4G network, which are of higher quality and can be switched from an audio call to a video call—are likely to supplant traditional phone calls over the next decade.

Another common concern and question is Voice over IP (VoIP) as VoLTE or VoIP in another means. Take VoIP services like Skype, Viber and WhatsApp. VoLTE goes beyond these in aspects like being able to handle radio networks’ handover and support emergency calls. The technology also promises superior voice quality. But are Generation Cloud customers willing to pay extra for this? It’s highly unlikely.

So, if VoLTE supplants traditional phone calls, will it significantly improve operators’ business by presenting a revenue boost for voice? Again, this is highly unlikely. Based on the VoLTE services on the market thus far, it seems that these voice calls are charged similarly to ordinary ones, where video comes on top in form of data charging.

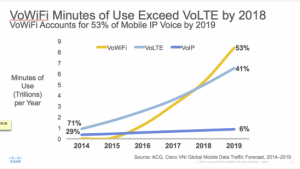

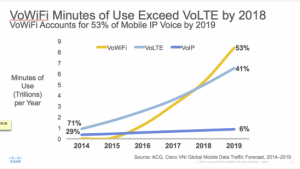

Source: Cisco Blog

Here comes the interesting expansion of the voice business, which VoLTE indirectly enables: native Wi-Fi calling (or Voice over Wi-Fi or VoWiFi). Every cellular network—no matter how good it is—will have coverage issues indoors. In most cases, there’s Wi-Fi coverage to act as support.

With native Wi-Fi calling, mobile customers will seamlessly carry calls over existing Wi-Fi when there is no cellular coverage. Similarly to VoLTE, these calls are charged as any regular voice call, but here we are talking about a call that could not have happened without Wi-Fi. Consequently, it means additional voice revenue for the operator (or it could mean unlimited voice plans become more frequent). The same IMS handles both VoWiFi and VoLTE—with the latter technology being a pre-requisite for handover to happen between VoWiFi and cellular. (If you don’t have cellular indoor coverage, you obviously need to be able to move in and out of your house without dropping calls.)

With this in mind, we should stop looking at VoLTE in isolation and instead consider VoLTE in tandem with VoWiFi.

VoLTE also offers huge potential for cost-savings. When voice and other services are converged on LTE, and when customers have fully bought into them, digital and communications service providers are able to shut down their circuit-switched 2G and 3G networks. This will have a huge impact on operators’ profitability.

So do digital and communications service providers possess the knowledge and assets for what it takes to launch VoLTE successfully? We’ll discuss this in a coming blog post—please stay tuned.

Malla Poikela of Comptel co-wrote this blog post entry.

Posted: May 21st, 2014 | Author: Malla Poikela | Filed under: Industry Insights | Tags: data, LTE, PCRF, policy control, voice, VoLTE | No Comments »

The arrival of voice-over-LTE (VoLTE) technology has been buzzed about by carriers for several years now, but at the Policy Control and Data Pricing 2014 conference in Berlin, it became very obvious that the VoLTE future is no longer on the horizon: it’s here.

“The window of opportunity is now,” urged Alex Harmand, head of service platforms for Telefonica. Telcos are heeding that call. Approximately 10 percent have some of form of VoLTE service in place, and according to the GSMA, 20 more VoLTE deployments are expected this year alone.

VoLTE is happening now, and fast; however, CSPs still have many questions about their approach to the technology. For one, policy control and charging rule function (PCRF) solutions are needed for each voice call in VoLTE. Are CSPs designing their VoLTE architecture by implementing a common or dedicated PCRF?

What’s more, how can CSPs make sure the voice user experience is superior to VoIP services, and equally important, that the quality is as good as—or surpasses—that of current 2G/3G voice services?

VoLTE Benefits for CSPs

As one speaker reminded conference attendees, voice remains a core revenue generator, representing 70 percent of carriers’ global revenues—about $600 billion. This represents a huge opportunity and incentive for CSPs if they can rise to the occasion of leveraging VoLTE as a part of a suite of communications services.

That’s where VoLTE comes in. From CSPs’ perspective, VoLTE will make it possible for voice services to be run on their networks much like any other application. This means that voice calls and data sessions can travel side-by-side over LTE, creating the possibility of innovative new services that combine the two.

Cost reduction is one of the biggest draws for CSPs toward VoLTE services. When voice services are run through LTE/IMS, it was presented in the conference that twice as many voice calls can stream through the same spectrum. More calls mean more opportunities for CSPs to grow their revenues.

What’s more, policy and service opportunities can grow, scalability and performance can improve, and CSPs can experiment by separating data and voice into different packages.

Building a Business Case for VoLTE

Conference attendees were vocal on the business case for VoLTE and whether the costs associated with developing new voice services could be recouped by providing new capabilities.

VoLTE shows strong potential for CSPs. Voice is still a dominating revenue generator, thus VoLTE represents a viable opportunity. In addition to the efficiency gains that channeling voice and data traffic over a common network promises, the case for VoLTE may lean on how successful these tools are in helping CSPs.

Divisions on PCRF

Conference attendees agreed that PCRF will play an integral part in the VoLTE architecture. One speaker even called VoLTE a “game changer” for PCRF. It’s evident that telcos are actively looking to re-evaluate their policy management solutions against VoLTE’s new set of requirements.

But while speakers agreed that PCRF would need to be a focus, many were divided on the best route for tackling these changes. Harmand of Telefonica vocalized that a unified strategy to PCRF would be ideal, but a separate PCRF for VoLTE may make more sense for financial purposes.

Another countered that technically, it makes the most economical sense to utilise one PCRF across the entire network, and while another agreed on this technical point-of-view, s/he voiced concerns that the current implementations on PCRF installations might be a significant challenge to merge.

VoLTE is Here to Stay

The final verdict on VoLTE is this: it allows for superior voice calls, possible revenue growth and cost savings, thus providing a motivator for CSPs and users to adopt the service. While it’s not clear how long the path toward integration and bottom-line improvements will take, it’s very obvious that VoLTE is here to stay, and we’ll see a lot of new deployments in the coming months.

Posted: February 26th, 2013 | Author: Ulla Koivukoski | Filed under: Events, Industry Insights | Tags: AT&T NFC, China Mobile, GSMA, key notes, LTE, mobile wallets, Mobile World Congress, OTT, Telefonica Group, Vodafone, VoLTE | 3 Comments »

The excitement was (and still is) palpable here in Barcelona, as Mobile World Congress kicked into full gear yesterday. The keynote sessions on day one did not disappoint, with four of the largest mobile operators across the globe outlining their business strategies over the past year and looking ahead to 2017 and beyond. First up was chairman of the GSMA and CEO of Telecom Italia Group, Franco Bernabè, who stated that spectrum, privacy and investments must be the key focus for mobile operators moving forward.

Sixty-two million wireless connections are already using LTE, and this number is expected to grow to 920 million by 2017. Spectrum, then, is clearly a priority. However, as Bernabè explained, it’s critical to do more than simply having the right amount of spectrum—mobile operators must ensure that it is also harmonised across the world, in turn, making mobile services more affordable for consumers.

Privacy is another element for operators to consider, as mobile phones are carrying an increasing amount of personal information. With $350 billion compromised this year due to security risks, there is a clear place for mobile operators to become central in secure identity and access management.

Finally, Bernabè urged, operators must find a balance between competition, innovation and investment. Investments will depend on three factors: economics of scale, foreseeable business environments and up-to-date regulatory frameworks. He continued saying that operators must remain committed to Near Field Communications (NFC), LTE and voice over LTE (VoLTE) to create economically viable competition, especially in regions where excess competition is depressing the markets.

Following the opening remarks, GSMA’s director general, Anne Bouverot, moderated a discussion on the challenges and opportunities for mobile operators. AT&T’s president and CEO, Randall Stephenson, believes that we’re moving from a period of wireless experience on mobile devices to one where connectivity is always assumed and new services, like home security and mobile wallets, can be layered on top.

Next, China Mobile’s chairman, Xi Guohua, added that operators should be more concerned about OTT competition, which can erode the value of services. He suggests consolidating industry resources, like networks and devices, to gain a competitive advantage in the value chain. Additionally, Xi believes there is an opportunity with LTE to strengthen collaboration among the Internet of things, such as M2M, which will increase dialogue and align interests for the world’s operators.

Adding to this, Telefonica’s executive chairman and CEO, César Aliert, stated that operators need to lead the ecosystems into a healthy future by implementing new commercial models to better serve customers and change market dynamics. This includes breaking the taboos associated with network rollout and providing the best experience possible to customers.

Then, Vodafone’s CEO Vittorio Colao dove into how his group of operators is transforming in this digital revolution. Interestingly, he noted that more than a quarter of mobile users check their phones at the dinner table, and 66 percent sleep with their phones. Life is clearly mobile, and this is only going to increase. Because of this, Colao stated that operators need to enrich the customer experience with other services. Winners will be those who have the best products and lowest prices and are most willing to compromise and put in the work.

So far, the keynotes have been exciting to listen to, and the show floor has been packed! We’re looking forward to attending more sessions and meeting our customers, partners and other across the industry to share ideas about our changing telco landscape. In the meantime, stop by our booth in Hall 6, stand 6C30!

Posted: August 26th, 2011 | Author: OSS Team | Filed under: Around the World | Tags: Colombia, IMS, IP, Latin America, LTE, mobile, Nigeria, OSS/BSS, voice, VoLTE | 1 Comment »

Pipeline…

Where Does IMS Stand?

Tim Young asserts that IMS is making a comeback in large part due to the growth of LTE. While LTE is all IP, there is virtually no support for voice, and as such, IMS has become a real contender to fill this gap, specifically as it applies to Voice over LTE (VoLTE).

This trend toward increased usage is supported by a recent Infonetics Research survey, which found that 78% of respondents will have mobile-specific services deployed over IMS by 2013, a significant increase from 35% today. The analyst firm also identified the desire to offer converged services and deploy LTE as key IMS growth drivers.

When IMS first entered the industry, some critics noted slow carrier interest and grew skeptical of its longevity. Now years later, do you think this renewed carrier interest foreshadows a promising future for IMS?

Billing & OSS World…

Gov’t Plan, Smartphone Adoption to Drive Data Growth in Colombia

A Pyramid Research report predicts that the Colombian government’s plan to increase broadband access and the adoption of smartphones will fuel data growth throughout the next several years. The government wants to quadruple the number of Internet connections in the country to 8.8 million, and is putting special emphasis on the availability of infrastructure for broadband coverage. This plan, along with handset vendor competition, more spectrum availability and decreasing smartphone prices, is expected to maintain Colombian telecom market growth.

This view reinforces predictions that Latin America will see broadband penetration skyrocket over the next five years and the amount of subscribers increase to 150 million-plus. Managing these new customers and services will be critical, and OSS/BSS will certainly play a significant role, allowing the region’s communications service providers (CSPs) to focus on their core business.

allAfrica.com…

Nigeria: GSM at Ten in Nation

August marks the tenth year since GSM was introduced in Nigeria. GSM made telephone access available to everyone, eliminating the age-long dominance of the wealthy on telephone use. But, the most prominent result of GSM can be seen in the tremendous growth of subscribers, rising from 450,000 fixed lines in 1999 to 90 million active lines, fixed and mobile, today. This figure is expected to rise even higher to 118 million mobile subscribers by 2014.

As IDC analyst Andy Hicks notes, developed market telcos can learn from the achievements of CSPs in emerging markets such as Nigeria. These include aspects like offering compelling services and real-time solutions, as well as identity management. What are some telecom trends you’ve seen in emerging markets that others can draw inspiration from?

LTE – The Voice Problem

Posted: March 23rd, 2011 | Author: Simo Isomaki | Filed under: Industry Insights | Tags: 2G, 3G, IMS, LTE, VoLTE | 2 Comments »

A few months ago, I wrote a blog about whether LTE was breathing a new life into IMS. I received a lot of comments, and that post has been one of the most popular on the “The Dynamics of OSS”. Clearly, I touched a nerve there!

This time, I would like to look at how operators plan to solve “the voice problem” in LTE. Yes, voice! Given the revenue operators still make from voice services, one would have thought they would have made voice a priority. In fact, the focus so far has been almost entirely on faster data. However, the “voice problem” won’t go away.

The problem arises because 2G/3G voice is basically circuit switched, not packet transport. LTE, on the other hand, is all-IP, packet transport with no ‘circuit’ at all. This creates quite a problem for operators when they decide to transition voice from 2G/3G to LTE.

Currently, operators with LTE are considering three options to support voice:

- VoLTE (GSMA- and 3GPP-backed Voice over LTE, basically voice services in IMS core)

- VoLGA (Kineto Wireless-supported alternative Voice over LTE using Generic Access or UMA also known as unlicensed Mobile Access)

- CSFB (Circuit Switched FallBack, prior to Voice over LTE, the 3GPP-backed standard)

As it relates to voice calls, CSFB is principally not LTE at all. The radio connection is moved to a circuit-switched 2G/3G radio connection (and LTE radio is not on). As a result, data sessions (web surfing, data streaming, etc.) would be cut unless the device has a dual radio mode (LTE and 2G/3G radio on at the same time), which apart from consuming more battery life, this would generally be a bad compromise.

VoLGA is a somewhat of a competing offering by Kineto among others. It proposes to bridge the gap between LTE and CSFB, but would require each handset and device to also support VoLGA. So far, the adoption of VoLGA appears to be limited.

This leaves VoLTE. VoLTE seems to be the winner, as it is backed by all of the major network and device vendors. However, it mandates IMS back-end core and also forces all services in existence in 2G/3G voice (IN services, prepaid, roaming) to be re-implemented in IMS, which is clearly a big and potentially expensive challenge for operators. VoLTE would support the handover of radio to ensure voice call continuity in a single-radio mode (very good for sparing battery consumption), but some work is still needed in the standardisation for the handover process from 3G to LTE.

LTE could also naturally drive OTT (over the top) voice services (e.g. Google Voice, Skype, etc.) , but the challenge is that the handover to 2G/3G radio would cut the data sessions and disconnect voice. As LTE coverage will most likely not be 100% (at least for most European operators), this will most likely impact some users. That being said, it would only affect truly mobile customers. Nomadic customers, who are essentially stationary, would not have to face that problem and could use OTT services to the detriment of operator revenue.

However, it seems many operators have decided to tackle the challenge by first driving the rollout of LTE by using data only. Then, when coverage and hunger for more data is handled—and handled well—the assumption is that voice can more easily be put onto the network. I’ve heard rumours that larger international groups are building a central IMS core to be shared between their national operating companies (the LTE radio part would remain separate). This would help to drive the business case for IMS, as IMS costs are split between the operating entities. However, sharing IMS rollout costs perhaps will not be available to smaller, independent operators then.

With CDMA, the world is ’simpler’ as the 3GPP2 standard for handover procedure from LTE to CDMA is not available, and at least Verizon is not even looking into that.

Needless to say, all of this will have an impact on back-end systems, like charging and policy control, as well as service creation and activation, which will require special attention—especially in the complex world of hybrid LTE+2G/3G networks, where services still need to be created and charged for so that they seamlessly work during handovers.

There has been a lot of

There has been a lot of